The Market Frenzy Continues. For Now.

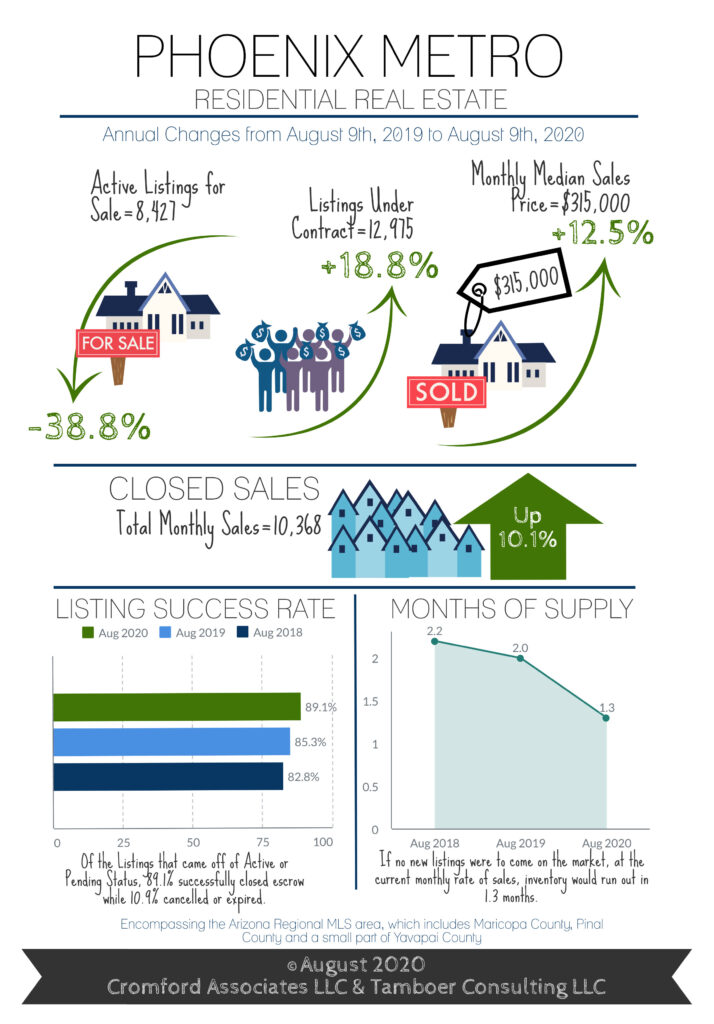

As counterintuitive as it sounds, the pandemic has fostered a frenzied real estate marketplace. Sellers “sheltering in place” have been slow to come to market during this period – causing supply to plummet. The pandemic can’t take all the credit though. Record low interest rates and lack of new build home creation thru the last 13 years have also played a role. In fact the low interest rates have improved affordability (and thereby demand) despite the rising prices in the valley. In fact here are some interesting numbers from Tina Tamboer of the Cromford Report on the “Home Opportunity Index” (HOI*) which is calculated on pricing, lending guidelines, interest rates, and medium pricing in an area.

“It’s a jungle out there for buyers, but despite recent appreciation rates the HOI* measure for Greater Phoenix increased to 64.8 for the 2nd Quarter 2020; the previous measure was 63.0. This means that a household making the current median family income of $72,300 per year could afford 64.8% of what sold in the 2nd Quarter of 2020. By comparison, the HOI measure for the United States was 59.6. Historically, a normal range for this measure is between 60-75. During the “bubble” years of excessive appreciation between 2005-2006, the HOI plummeted from 60.1 to 26.6. Typically if it falls below 60, the market should start to see a drop in demand. With the most recent increase however, Greater Phoenix is still within normal range and experiencing demand 20% above normal for this time of year.”

This market is very different from the 2005/6 market. Then we had a glut of supply (housing growing faster than population) that we simply don’t have today. Today we have the opposite issue – population growing faster than housing. Consequently we have the hottest market for sellers since 2006. But if history is a teacher, we have learned that markets like this don’t last forever. To that point, Tina further comments:

Contracts on luxury homes over $1M are up an incredible 93% over last year at this time. Between $500K-$1M, contracts are up 64%. Between $300K-$500K, they’re up 39%. Between $250K-$300K, up 15%. If you need to sell, this is the time to do it.

…This type of market and appreciation is not sustainable over time, however it’s here now and properties purchased today are expected to continue appreciating over the next 6-12 months.

It is rare that we say both “if you can buy, buy now” and “if you want to sell, sell now”. But that is what we suggest. Further market questions? We are always delighted to examine your particular neighborhood!

If you have questions about the market – as always, call us 602-957-7777. We are watching these market patterns closely.

Russell & Wendy Shaw