What Are The Current Market Patterns?

Enough time has passed since Arizona’s “stay at home” orders that we can now see the patterns established in the valley’s real estate market:

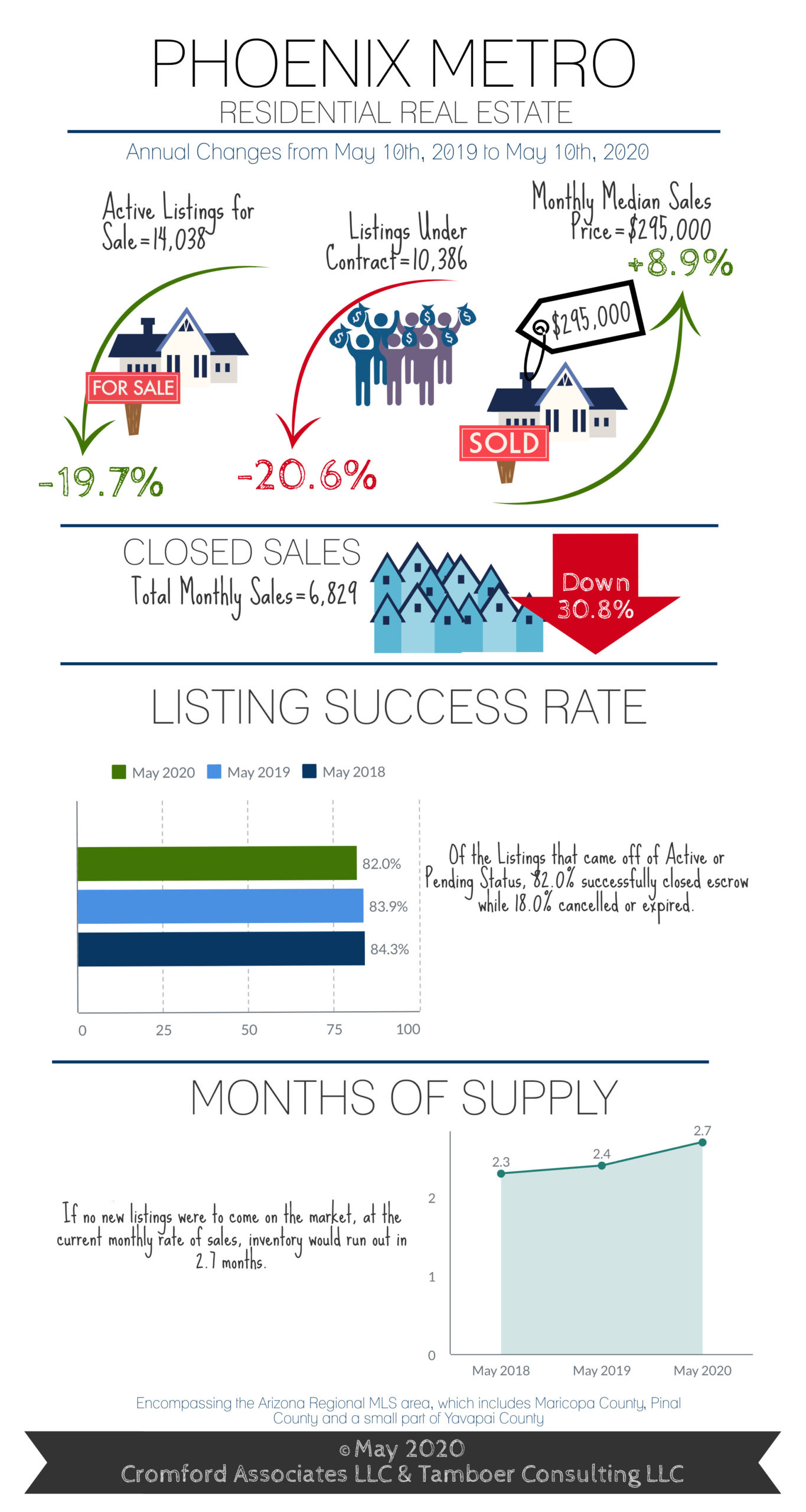

- Greater Phoenix homes under contract dropped 39% over the course of 6 weeks between March and mid-April. Not surprisingly, this resulted in closed transactions dropping 31% a month later.

- But that’s already old news, what is not getting reported yet is the 40% increase in accepted contracts over the past 4 weeks.

- Essentially the market temporarily “shrunk” – which means less buyers and sellers were in the market. This does not mean prices dropped. In fact the under 500K market saw not only stable prices, but even price increases.

- The market over $500K is recovering slower than other price ranges after dropping 58% in weekly contracts due to travel restrictions and the stock market crash from late February through March. While contract activity rose 65% over the past 4 weeks, it’s still down 30% from its peak 10 weeks ago. The irony is that one would expect a massive number of price reductions after such a dramatic drop in demand, but that was not the case. Instead, sellers over $500K simply came off the market. The highest percentage of cancelled listings were seen in the luxury market, which reduced supply and mitigated the loss in demand. As a result, sales prices over $500K have remained stable thus far and are up just 0.9% from this time last year.

- What is being sold has changed. This will cause a lower price per sq. ft. for homes sold due to the mix favoring lower priced housing. If you see headlines saying the prices are dropping due to lower price per square foot – realize that is not a price drop but rather that the homes being sold are less expensive.

- Mortgage rates are down from this time last year. The biggest mistake buyers can make is waiting for price drops that are not coming. Low mortgage rates are not something to ignore or take for granted as they can change quickly.

Our thanks to Tina Tamboer of the Cromford Report for providing market statistics. To summarize, we believe the impact of the Pandemic has been largely in reduced numbers of transactions. The jump in contracts suggests the worst of the impact is behind us. There are blue skies ahead. If you have questions on buying or selling or how to do so “safely” in this market – we are here to explain all of your options.

Russell & Wendy Shaw