DEMAND WEAKENS

The market has been shifting since March when the properties available for sale hit its smallest number. As we mentioned before, this market has been largely controlled by the supply (or more accurately, the lack thereof). Supply is finally starting to march upwards in a way that indicates the extreme seller market is rapidly moderating to just a plain old sellers’ market.

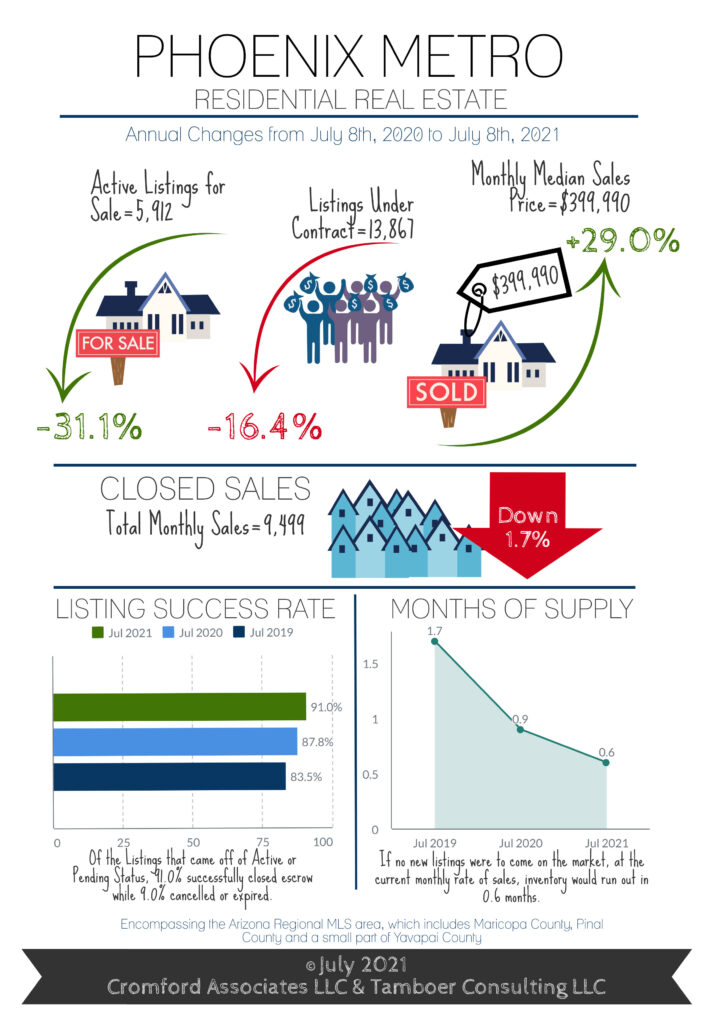

Here are some interesting facts from Tina Tamboer from the Cromford Report:

- …price points between $400,000 and $800,000… inventory has grown 92% since February.

- A family making the median income in Greater Phoenix could afford 63% of what sold in the 1st quarter of 2021. That was within the normal range of 60-75%, indicating a good time to buy or sell. While we wait until August for the 2nd quarter measures to be released, we expect the new measure to land around 57%, slightly below normal. This does not indicate that the market will plunge into a buyer market causing prices to decline, but it does indicate a reason to expect prices to rise much slower going forward.

- Over the next 5 months, give or take, the market is expected to move into a weaker seller market, driven in part by dwindling affordability and buyer fatigue.

- April 2021 saw prices appreciate 5.1% within 4 weeks. May was 2.3%. June was 1.1%. From 2015-2019, a long-term seller market but much weaker than today, prices appreciated at an average of 0.5% per month with a range between 0.3% and 0.8%.

- There will be more list price reductions. It’s important to remember that the sales price is the LAST thing to respond in a shifting market. One of the first things to respond is a list price, in the form of a price reduction. When a seller overshoots what the market can bear, they will get the silent treatment in the form of zero offers. That triggers a price reduction by the seller. Weekly price reductions have risen 112% since mid-February from 317 in a week to 672.

In short, this market is changing. More sellers are coming to market motivated by higher prices to sell, and less and less buyers are willing and able to pay those prices. Sounds like a pretty good time to sell before word gets out.

As always, we will continue to watch the numbers and keep our clients informed. Want an up-to-date forecast for the market whether buying or selling? We are here to help and inform. Contact us.

-Wendy And Russell Shaw