THE HIDDEN FACTOR IN

TODAY’S REAL ESTATE MARKET

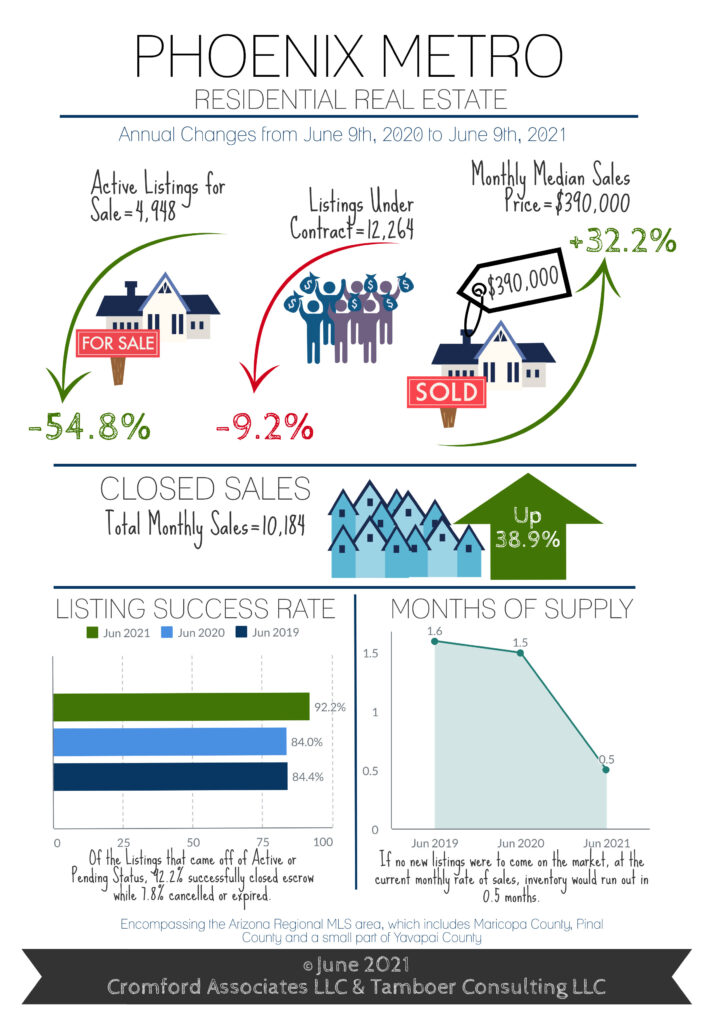

The Median price for homes in the greater Phoenix area is up a whopping 32% from 2020. Prognosticating the real estate market is a thankless job – but unlike the stock market some predictions are fairly safe to make.

What to know if you are a buyer:

Prices are going to continue to go up until supply increases significantly. The exact amount and rate of appreciation is what is unknown. The fact that they will continue to rise is predictable. If interest rates are low (they are, but won’t be forever) and prices are going to rise for the next year (they will) it makes sense to buy now. So our advice? If you are a buyer who can buy, buy now.

What to know if you are a seller:

Seasonally the market typically slows in the back half of the year once the spring buying season is over. Last year the pandemic extended the buying season as people could not flee the valley for vacations. This year we expect, as in years past, activity to gradually slow through the end of the year. However, as long as supply remains low, prices will increase – just not as rapidly as the first half of the year. To quote Tina Tamboer of the Cromford Report: “At its current rate of decline, the Greater Phoenix market is still projected to remain in a Seller Market for 16 months. That’s a target of October 2022 before prices stop rising. As the Seller Market weakens, appreciation rates will still be positive moving forward but there will be a little more supply to accommodate demand.”.

Hidden Market Factor: But there is a hidden market factor that sellers should be aware of that could affect them. The expiry of Governmental home retention programs. Tina further explains: “However this year there’s an event coming up that could alter that scenario, that is the end of forbearance for many homeowners. While the vast majority of forbearances have ended with homeowners staying in their home, anywhere from 16%-20% have resorted to selling their home one way or another according to the Mortgage Bankers Association. This could result in an increase in supply over the next few months, adding extra days of marketing time to your listing and possibly a few price reductions.” For sellers concerned about this, now may be the time to sell.

As always, we will continue to watch the numbers and keep our clients informed. Want an up-to-date forecast for the market whether buying or selling? We are here to help and inform. Contact us.

-Wendy And Russell Shaw