The Market Roars Back

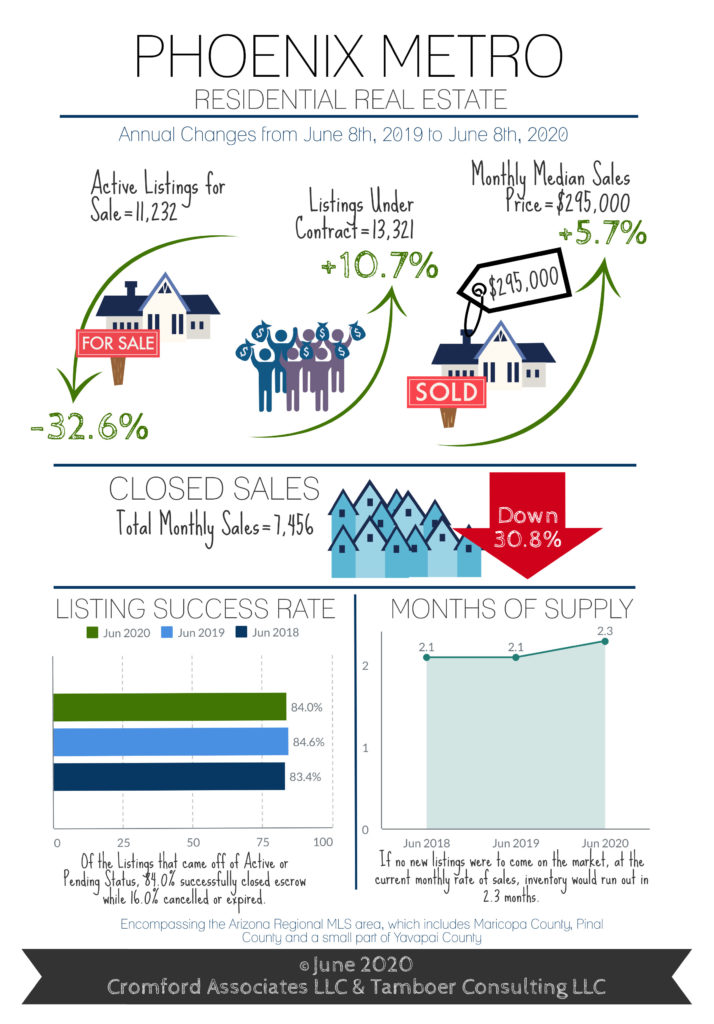

The valley’s real estate market has once again returned to the level of “frenzy” – with the number of properties under contract exceeding what is for sale. As of 6/10/20 there are 10,764 active listings. The number of properties with an offer are at 13,669 – that’s 2905 more homes under contract than what is available for sale. This may be a shock for those who believe that the pandemic has crushed our real estate market. What actually happened was a fast punch, followed by a surprisingly quick rebound. Demand has proven it can only be held down so long. In fact, to quote Tina Tamboer of the Cromford Report:

“Over the past 4 weeks the number of contracts accepted weekly has jumped another 20% since last month’s report, bringing the total recovery since April 5th to 68% and 2.5% higher than it was in late February; before the stock market crashed and the stay home orders were imposed due to COVID-19.” You read that correctly – the market has recovered on contracts to above pre-virus levels. To further quote Ms. Tambour:

“While all price ranges have rebounded in contract activity, May saw the largest comeback between $500K-$1M where the number of accepted contracts soared 167% from a low of 148 contracts the first week of April to 395 the first week of June. That’s 58% higher than last year’s count in the same week of 250 contracts. Even more dramatic, contracts over $1M are now up 85% compared to this week last year. The result for buyers is an inventory that’s back to a pre-pandemic low.”

Sellers who have questioned whether now the time to sell should consider Ms. Tambour’s advice:

“Sellers who have been on the fence about listing their home lately should seriously consider it now and take advantage while the market is hot. This spurt in buyer activity may peak very soon and then fall into the typical seasonal decline the Greater Phoenix market experiences every year from July to December. Pent up demand from the pandemic is now being released, but there’s no guarantee that it will continue.”

Buyers who are wondering if to buy now, here is her advice:

“Low interest rates and positive affordability indicators continue to fuel demand and cause prices to rise. The big question buyers ask, “Is it still a good time to buy?” The answer is yes, for now. Affordability is still within normal range, which is a good reason why there’s so much demand. However, if affordability drops below the normal range for those making the median family income, then the market will begin to cool. We are not there yet. It’s best to get in while it’s affordable.”

If you have questions about your particular situation or neighborhood, we are here to help.

-Russell & Wendy